A Comprehensive Guide to Taxes, Trading, and Investments

To achieve success in trading and investing, you need to master the art of tax management, select effective trading strategies, and invest wisely. In this article, we will dive into topics like the best stocks for day trading, along with other important financial concepts, such as derivatives, AI stocks, and the traceability of Bitcoin.

### Paying Taxes on Stock Gains: What You Need to Know

If you sell a stock for a profit, you’ll need to pay income tax on that gain. The timing of your tax on unrealized gains obligation depends on how long you’ve held the stock. If you sell the stock within one year, the gain will be taxed as short-term capital gains, which are taxed at your regular income tax rate.

On the other hand, if the stock was held for more than 12 months, the gain is subject to long-term capital gains tax, which generally has a lower tax rate. Be sure to document your transactions to accurately report and pay the correct amount of taxes on stock profits.

### Using MACD for Day Trading Effectively

The **MACD** (Moving Average Convergence Divergence) is a popular indicator for day traders. The standard MACD settings of 12, 26, 9 are commonly used, but adjusting these settings can help you enhance your trading strategy.

For day trading, more responsive indicators may help you identify trends more quickly. It’s important to experiment with different settings based on the stocks you’re trading to improve your ability to spot profitable trades.

### Good Stocks for Day Trading: Finding the Best Opportunities

The best stocks for day trading are those with frequent price swings. Stocks like NVIDIA are popular among day traders because they experience significant price movement within short periods, which is ideal for quick profits.

Top picks for active traders include companies with high liquidity. Look for stocks that show signs of impending movement to maximize your day trading profits.

### What Is Full Port in the Context of Trading?

In trading, a **full port** refers to a portfolio that is completely allocated to a particular asset or strategy. For instance, if you’ve invested all your funds in a particular stock, option, or cryptocurrency, you are said to have a full port in that asset.

Balancing your portfolio is essential to understanding the risk and exposure of your investments. A full port strategy may work for some traders, but it exposes you to higher levels of concentration of assets.

### Understanding EQL in Financial Trading

In financial trading, **EQL** can refer to an **Exchange-Traded Fund (ETF)** or an **equilibrium strategy** used to maintain a balanced portfolio. The goal of an EQL investment strategy is to provide diversified exposure to multiple assets while minimizing risk.

EQL ETFs are useful for investors who seek to optimize returns in their portfolios, especially when focusing on long-term growth with minimal volatility.

### Derivative Contracts: What Are They?

A **derivative contract** is a financial instrument whose value is based on an underlying asset such as a stock, bond, or commodity. Common types of derivatives include options contracts, and they allow traders to hedge risks on price movements of the underlying assets.

Derivative contracts can be used to maximize returns, but they come with heightened complexity and market risk. It’s important to understand how derivatives work and their impact on your portfolio before trading.

### Best Long-Term Investments: What to Buy for Long-Term Growth

Long-term investments typically grow steadily over time and are often seen as less volatile than short-term trades. Some of the best long-term investments include bonds, which tend to perform well over several years.

By focusing on reinvesting dividends, you can build a portfolio that provides steady growth over time. Long-term investments are ideal for retirement savings.

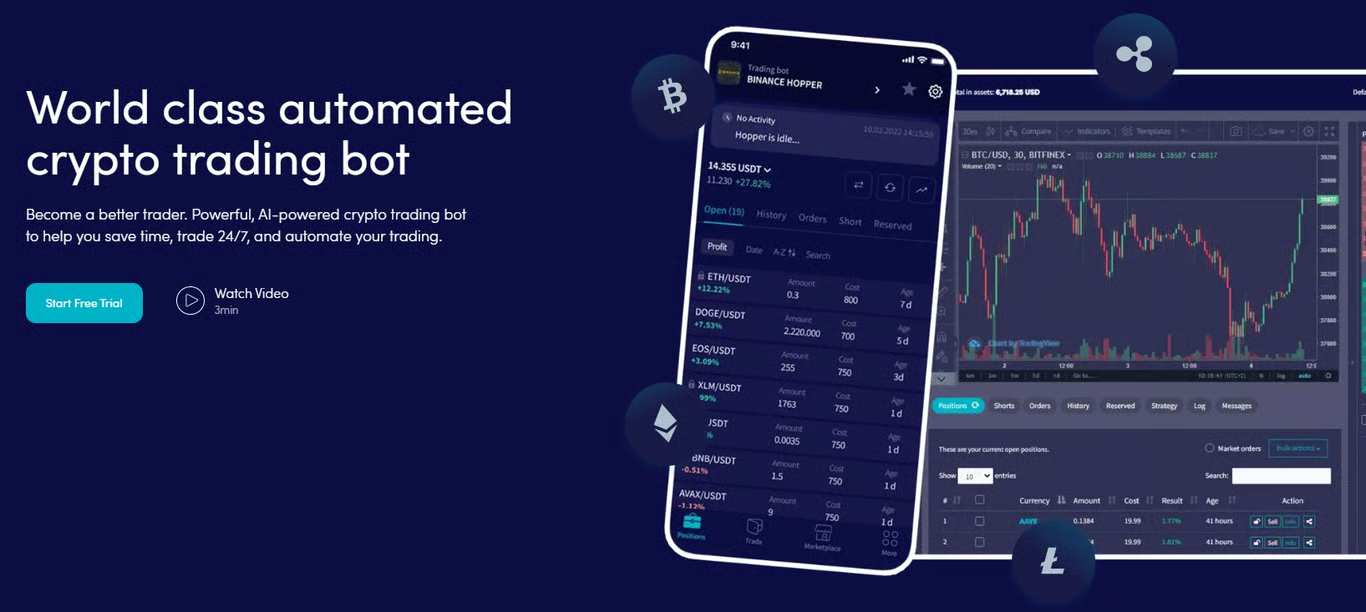

### What Is API Trading?

**API trading** is a method of automating your trading strategies through application programming interfaces (APIs). APIs allow traders to access real-time market data through third-party software.

Algorithmic trading is a powerful tool for high-frequency traders, as it allows for data-driven decisions. With API trading, you can minimize human error in your trading activities.

### Best AI Stocks for Budget-Conscious Investors

Investing in AI stocks doesn’t have to be expensive. Many AI stocks are priced under $3, offering an affordable way to get in on the ground floor of this rapidly growing sector. Companies like Palantir Technologies are good examples of affordable AI stocks with significant growth potential.

These stocks allow investors to get in early on innovative technology without needing a large capital outlay. However, always research these stocks thoroughly to understand their growth prospects.

### Is Bitcoin Traceable? How Traceable Is Bitcoin?

Although Bitcoin transactions are often thought to be anonymous, they are actually traceable. Every Bitcoin transaction is recorded on the blockchain, which is a public ledger that anyone can access. However, the identities behind Bitcoin transactions are not immediately visible, making it harder to trace unless additional information is available.

Bitcoin provides a higher degree of privacy compared to traditional payment systems, but it is still traceable. For full privacy, Bitcoin users can take steps like using privacy wallets.

### The Key to Financial Success: Understanding Taxes, Trading, and Investments

To succeed in trading and investing, you need to understand tax laws. Whether you’re paying taxes on stock profits, optimizing your MACD settings for day trading, or looking for the best long-term investments, staying informed is crucial.

making smart investments, you can minimize your risks. Always stay updated on the latest trends in trading to ensure you’re making the best decisions for your financial future.