Farm Equipment Rental Market Trends, Growth & Forecast 2025-2033

Market Overview:

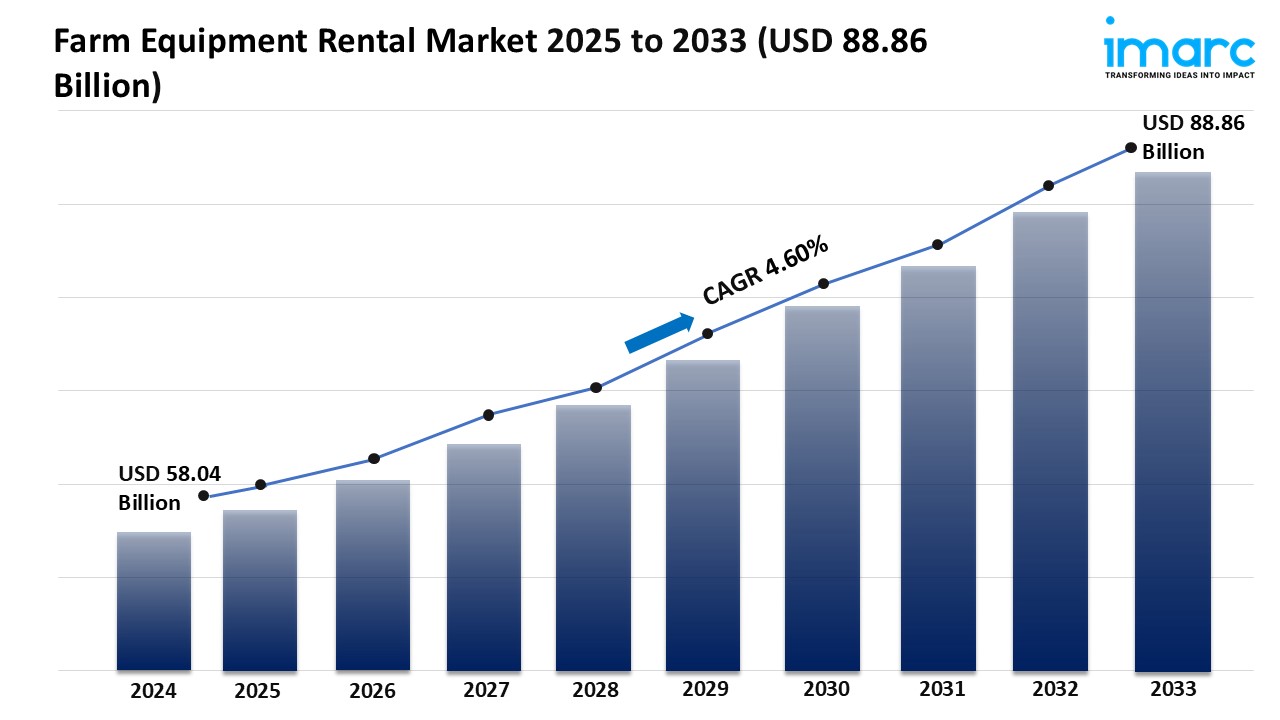

The farm equipment rental market is experiencing rapid growth, driven by rising adoption of precision agriculture, increasing costs of farm ownership, and growing demand from small-scale farmers. According to IMARC Group’s latest research publication, “Farm Equipment Rental Market Size, Share, Trends and Forecast by Equipment Type, Drive, Power Output, and Region, 2025-2033”, the global farm equipment rental market size was valued at USD 58.04 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 88.86 Billion by 2033, exhibiting a CAGR of 4.60% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/farm-equipment-rental-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Farm Equipment Rental Market

- Rising Adoption of Precision Agriculture

The rise of precision agriculture is an important contributor to the growth of the farm equipment rental market. Precision agriculture leverages a variety of advanced technologies, such as drones, GPS-guided tractors, and variable-rate applicators, to help farmers maximize crop yields and minimize input costs. However, the expense associated with the purchase of such complex equipment is often impractical (or unaffordable) for many farmers, particularly smaller and mid-sized farms, and renting allows the farmer to access higher-level equipment without a long-term financial obligation. For example, John Deere has a program where it rents precision-enabled machinery, allowing farmers to practice data-driven agriculture. This trend will help sustain agriculture while it, at the same time, creates additional demand for renting equipment due to the ability for farmers to have flexible access to equipment that is innovative.

- Increasing Costs of Farm Ownership

The quickly rising costs of ownership, which incorporates maintenance, storage, and depreciation, are more farmers are now considering rental options. Modern farm equipment, like combine harvesters or automated sprayers, has a very high price tag and could be considered economically burdensome for many smaller farms. It is much easier to take advantage of rental, which reduces some of the cost factors to simply the cost of usage. A study from the Midwest U.S. indicated that farms that rented equipment spent less on maintenance costs, compared to farms using owned equipment. This makes renting exciting for established farmers, and new farmers; thus creating a whole new potential market as rental providers expand their fleets to meet regional agricultural needs.

- Growing Demand from Small-Scale Farmers

Small-scale farmers, who often lack the capital to purchase equipment outright, are increasingly driving demand in the farm equipment rental market. These farmers require access to high-quality machinery to remain competitive but cannot justify the expense of ownership. Rental services provide a practical solution, offering flexible terms and a range of equipment tailored to smaller operations. For example, platforms like BigRentz have gained popularity by offering compact tractors and attachments suitable for small farms. This accessibility empowers small-scale farmers to boost productivity and adopt modern techniques, contributing to market expansion as rental providers cater to this growing segment.

Key Trends in the Farm Equipment Rental Market

- Expansion of Digital Rental Platforms

Digital platforms are disrupting the farm rental equipment rental industry by making equipment faster to access for farmers. Digital platforms or online marketplaces, connect farmers and rental providers and allow real-time access to product availability, price, and specifications. Many of these platforms were designed to be convenient for farmers, allowing them to find and book equipment from their smartphones. For instance, Farmequiprentals.com allows farmers to review rental options, place bookings, and delivery of equipment. This is particularly relevant to farmers in rural areas who may have very little access to rental depots. Many of these platforms are constantly improving by adding features such as customer reviews, and predictive maintenance alerts, responding to farmer needs, and increasingly competitive market competition.

- Shift Toward Sustainable Equipment

Sustainability is a significant trend in the farm equipment rental industry, where interest in environmentally friendly equipment is increasing. As farmers become more aware of their environmental impact, they are looking to add electric tractors or low-emission harvesters to their fleets. Rental providers are meeting this demand with the sustainable equipment options in their fleets. One example is Kubota’s electric compact tractors that can be rented in Europe; while they are electric, they have the ability to do all of the same work as conventional compact tractors while lowering carbon footprints. The sustainability trend is aligned with the changing global regulations around the environment and farmers’ desire for sustainably produced food. In turn, rental companies seek sustainability investments in green technologies that appeal to the emerging demographic of farmers interested in sustainable practices.

- Increased Focus on Flexible Rental Models

Flexible rental models are gaining traction in the farm equipment market, catering to the diverse needs of farmers. Providers are offering short-term, seasonal, and pay-per-use options, allowing farmers to align equipment usage with their operational cycles. This flexibility is particularly valuable for seasonal crops or unpredictable weather patterns. For example, Case IH’s rental program in Australia offers customized plans for wheat farmers, enabling them to rent combines only during harvest season. Such models reduce financial strain and improve resource efficiency, making rental services more appealing and driving market growth as providers innovate to meet evolving farmer demands.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging farm equipment rental market trends.

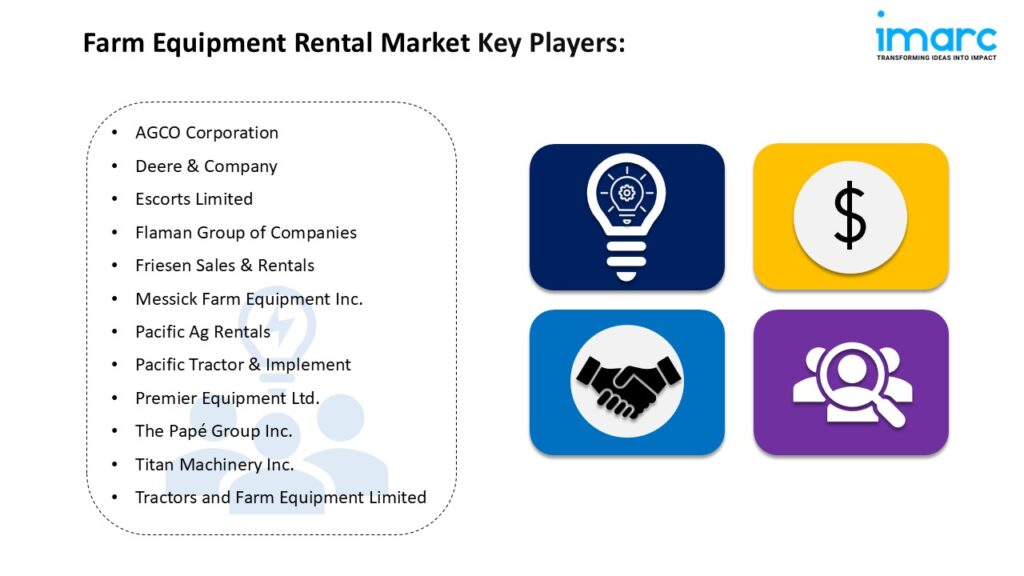

Leading Companies Operating in the Farm Equipment Rental Industry:

- AGCO Corporation

- Deere & Company

- Escorts Limited

- Flaman Group of Companies

- Friesen Sales & Rentals

- Messick Farm Equipment Inc.

- Pacific Ag Rentals

- Pacific Tractor & Implement

- Premier Equipment Ltd.

- The Papé Group Inc.

- Titan Machinery Inc.

- Tractors and Farm Equipment Limited

Farm Equipment Rental Market Report Segmentation:

By Equipment Type:

- Tractors

- Harvesters

- Sprayers

- Balers

- Others

Tractors dominate the farm equipment rental market with a 32.6% share due to their essential role in various agricultural activities and the rising preference for rentals over purchases among farmers.

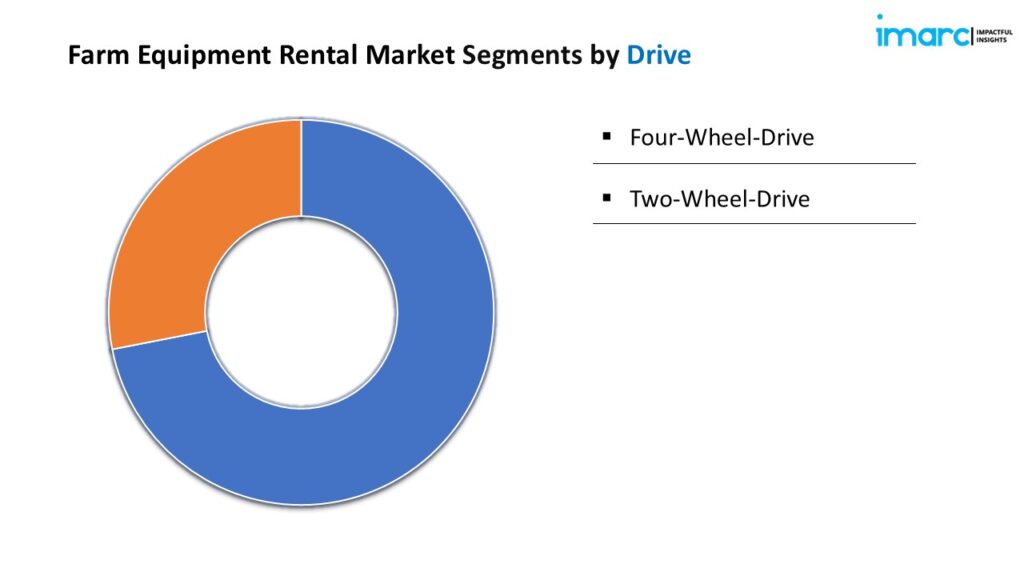

By Drive:

- Four-Wheel-Drive

- Two-Wheel-Drive

Four-wheel-drive (4WD) equipment leads the market with a 54.6% share, favored for its superior power and efficiency in challenging terrains, making it essential for large-scale farming operations.

By Power Output:

- <30 HP

- 31-70 HP

- 71-130 HP

- 131-250 HP

- >250 HP

The 71-130 HP segment is the largest in the farm equipment rental market, offering versatility and affordability for small to mid-sized farms while meeting diverse agricultural needs efficiently.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

The Asia Pacific region holds the largest share (34.6%) in the farm equipment rental market, driven by rapid mechanization, demand for cost-effective solutions among farmers, and government initiatives promoting rentals.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145