Understanding the Difference in Hedge Funds and Mutual Funds

Investing in the financial markets can be a complex journey, especially when trying to navigate the various types of investment vehicles available. Two of the most common options for individual and institutional investors are mutual funds and hedge funds. While both are pooled investment funds, they differ significantly in structure, strategy, regulation, and risk profile. Understanding the difference in hedge funds and mutual funds is crucial for making informed investment decisions.

What Are Mutual Funds?

Mutual funds are investment vehicles that pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other securities. They are highly regulated by government authorities, such as the SEC in the United States, which imposes strict rules on transparency, liquidity, and reporting. Mutual funds are popular among retail investors because of their accessibility, professional management, and relatively low minimum investment requirements.

What Are Hedge Funds?

Hedge funds are pooled investment funds that typically cater to accredited or institutional investors. They employ a wide array of investment strategies, including leverage, short selling, derivatives, and alternative assets, aiming to generate high returns regardless of market conditions. Hedge funds have fewer regulatory constraints compared to mutual funds, allowing them to pursue more aggressive and innovative strategies. As a result, they often come with higher fees and greater risks.

Key Differences in Strategy and Regulation

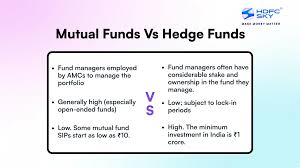

The difference in hedge funds and mutual funds is most apparent in their investment approaches and regulatory environments. Mutual funds generally follow passive or active investment strategies within a set of guidelines, which limits their scope of actions. Hedge funds, on the other hand, have the freedom to use complex, leveraged strategies, aiming to outperform the market even during downturns.

Risk and Return Profiles

Due to their investment strategies, hedge funds tend to have a higher risk profile but also the potential for higher returns. They often target absolute returns, seeking profit in all market conditions. Mutual funds typically offer more stable, long-term growth, suitable for investors seeking steady growth and lower risk exposure. Therefore, understanding the risk appetite is essential when choosing between these two options.

Liquidity and Fees

Liquidity is another differentiator—mutual funds usually offer daily liquidity, allowing investors to buy or sell shares at the end of each trading day. Hedge funds, however, impose lock-up periods and less frequent redemption windows, making them less liquid. Additionally, the fee structures vary greatly. Mutual funds usually charge expense ratios, while hedge funds often impose both management fees (typically 2%) and performance fees (around 20% of profits).

Who Should Consider Which?

If you are a retail investor looking for a low-cost, diversified, and regulated investment vehicle, mutual funds are generally a better choice. Conversely, if you are an accredited investor seeking high return potential and willing to accept higher risks and less liquidity, hedge funds might be suitable.

Conclusion

Understanding the difference in hedge funds and mutual funds enables investors to align their portfolio with their risk tolerance, investment goals, and liquidity needs. Both serve unique purposes within an investment strategy, and choosing the right one can significantly impact your financial future. For more detailed insights, visit the homepage and explore the extensive resources on investment funds.